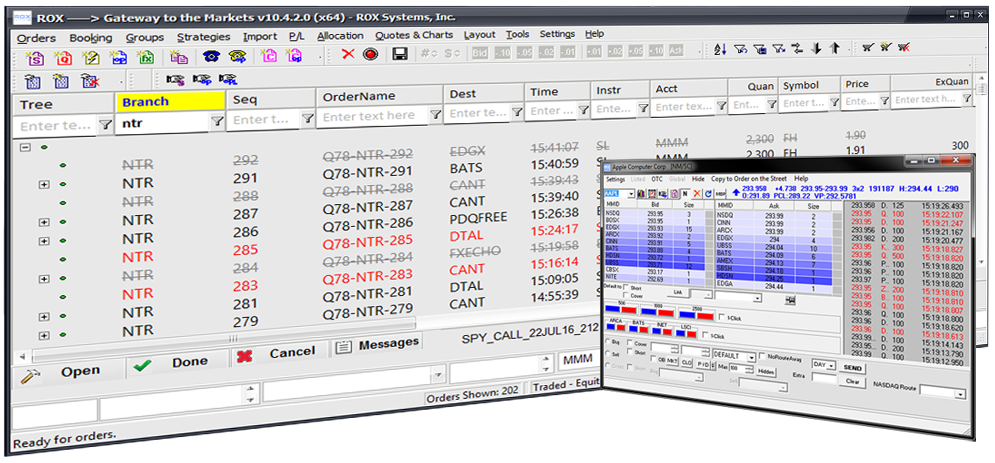

The ROX desktop trading platform is a sophisticated OMS/EMS that empowers traders by providing lightning fast access to exchanges, ECNs, dark pools, and market makers world-wide. Its speed, simplicity, and record-keeping abilities contribute to a performance edge in the marketplace. Customers with their own front-end systems can take advantage of the ROX low-latency order routing network by routing orders to ROX via the FIX protocol.

- The ROX Order API, based on Microsoft’s powerful COM architecture, allows traders to use proprietary programs to send orders and receive reports. It can handle thousands of messages per second.

- ROX can turn a Microsoft Excel spreadsheet into a real time order blotter, profit and loss display, or quote watch, and allows traders to develop Excel-based trading strategies.

- ROX is a front-end to domestic and foreign markets.

- ROX uses a powerful client/server model to communicate with its users.

- Connection to ROX is over LSC’s network, located in data centers globally, or via the internet. Either choice is fast and secure.

- The ROX FIX interface can support your preferred version of the FIX protocol.

Market Making

The Market Making module utilizes built-in algorithms to simultaneously place buy and sell orders for multiple securities. Immediate response to changing market conditions insures dynamic pricing, and reports flow back to the trader quickly and efficiently.

Pair & ADR Arbitrage

The Pairs Trading Manager monitors deviations in price, automatically buying or selling to capitalize on market inefficiencies. Minimal reaction time allows traders to take advantage of tight spreads and maximize gains. The strategy can be customized to send both legs simultaneously, or to trigger the second leg to route its orders as fills are received on the first leg. Additionally, for securities that trade in a foreign currency, the trader may choose to automatically hedge the currency as fills are received.

ADR/GDR arbitrage opportunities arise between ordinary shares and listed depository receipts in Latam, Europe, Asia, and U.S. Enhanced ADR arbitrage is possible since ROX considers the FX differentials when evaluating the price spread of a foreign stock versus the US ADR (US/Canada, US/Mexico, US/Europe, US/Asia).

Basket & List Orders

The Basket and List functionality allows traders to quickly enter basket (either buy or sell) & list (both buy and sell) orders. Traders may opt to send baskets and lists directly to DMA, to stage the orders and manually send out tranches, or to apply our algorithms to automatically send orders based on preferred parameters (TWAP, VWAP, POV). Advanced P&L analysis shows the trader's performance based on choice of benchmark price. Basket/List arbitrage is possible through Streaming Quotes.

Foreign Exchange

ROX provides access to the FX market to trade currencies. This includes all aspects of buying, selling and exchanging currencies at current or determined prices. There is no central marketplace for currency exchange; trades are conducted over the counter.

- Spot Transactions: A spot deal is for immediate delivery, which is defined as two business days for most currency pairs.

- Forward Transactions: Any Forex transaction that settles for a date later than spot is considered a "forward." The price is calculated by adjusting the spot rate to account for the difference in interest rates between the two currencies. The amount of the adjustment is called "forward points." The forward points reflect only the interest rate differential between two markets.

Options

The Options Point-n-Click window displays implied volatility and deltas associated with real-time quotes. Theoretical fair values are calculated based on historic volatility, or traders may specify volatility on a per-series basis. For faster execution, traders can “Sweep the Street” to access multiple markets with one-click to ensure that the order is filled quickly. Additionally, traders can specify the total number of contracts they want to execute and hit the bid/take the offer (at the best price or pay up to a specified price if desired) until they satisfy their quantity.

- The built-in theoretical options pricing model shows the delta equivalent position and gamma of the whole portfolio.

- Selecting an option series allows a trader to view his Option Analytics Chart and the Position Value Change vs. Stock Price vs. Date for a given range of stock prices and deltas.

- ROX offers an Options Analytics Calculator that will calculate the theoretical price or implied volatility based on strike price, stock price, expiration, interest rates, and the anticipated dividend stream.

Trade Securities in Foreign Exchange

- This module allows traders to specify a limit price in their currency of choice. As the stock or FX quotes move, the price on the order is adjusted. The trader has the option to have ROX automatically send FX orders as executions are received.

Continue to Middle Office